Investing in the financial market can be a daunting task for many, especially for those who lack the expertise or time to manage their investments actively. Mutual funds provide a solution to this problem by offering a way to pool resources with other investors to benefit from professional fund management. This blog will explore what mutual funds are, their benefits, and the different types of mutual funds available in the market.

What is a Mutual Fund?

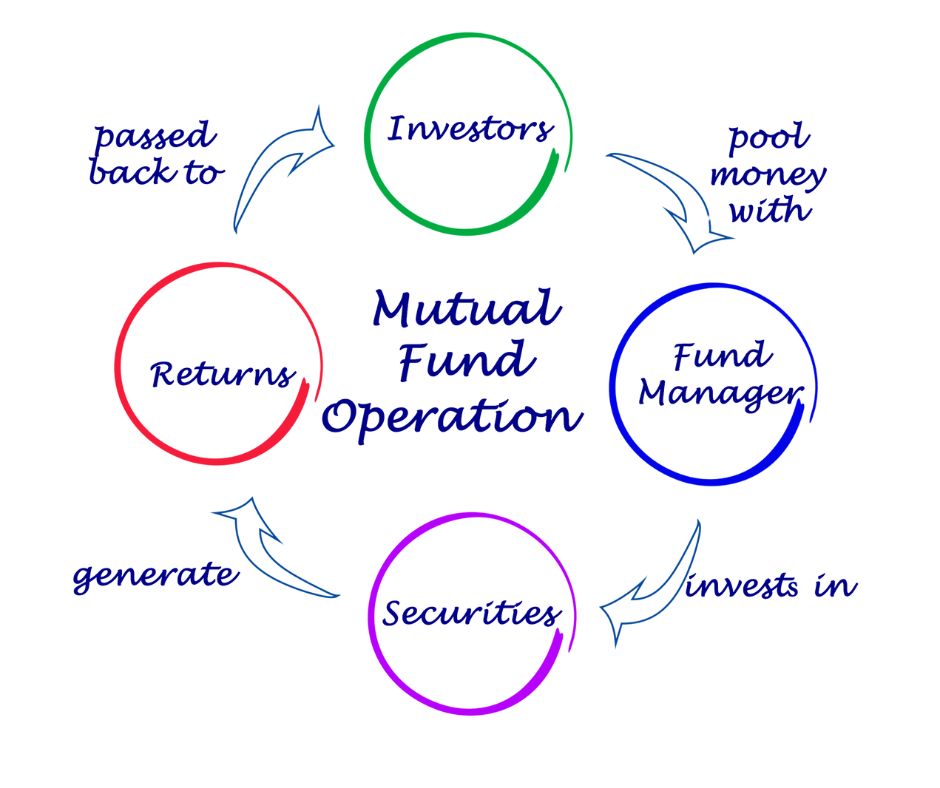

A mutual fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Each investor in a mutual fund owns shares, which represent a portion of the holdings of the fund. The funds are managed by professional portfolio managers who allocate the pooled money to different investments according to the fund’s objectives. if you read this article in hindi click here

Key Features of Mutual Funds:

- Diversification: Mutual funds invest in a range of securities, reducing the risk associated with investing in a single security.

- Professional Management: Fund managers have the expertise to make informed investment decisions.

- Liquidity: Mutual funds can be easily bought and sold, providing investors with flexibility.

- Accessibility: Mutual funds are available to all types of investors, with many requiring relatively low minimum investments.

Types of Mutual Funds

Mutual funds can be broadly classified based on their investment objectives, asset class, and structure. Here are the main types of mutual funds:

- Equity Funds

- Debt Funds

- Hybrid Funds

- Index Funds

- Sector Funds

- Money Market Funds

- Exchange-Traded Funds (ETFs)

1. Equity Funds

Equity funds, also known as stock funds, invest primarily in stocks. They are designed to provide capital appreciation over the long term. Equity funds can be further categorized based on their investment strategies:

- Large-Cap Funds: Invest in companies with large market capitalizations.

- Mid-Cap Funds: Target medium-sized companies with significant growth potential.

- Small-Cap Funds: Focus on smaller companies with high growth potential but higher risk.

- Growth Funds: Invest in companies expected to grow at an above-average rate compared to other companies.

- Value Funds: Invest in undervalued companies that are expected to perform well in the long term.

- Dividend Yield Funds: Focus on companies that pay high dividends.

2. Debt Funds

Debt funds, also known as fixed-income funds, invest in bonds and other debt securities. They are designed to provide regular income with lower risk compared to equity funds. Types of debt funds include:

- Corporate Bond Funds: Invest in bonds issued by companies.

- Government Bond Funds: Invest in government securities.

- Short-Term and Long-Term Bond Funds: Focus on bonds with shorter or longer maturities, respectively.

- Floating Rate Funds: Invest in bonds with variable interest rates.

- High-Yield Bond Funds: Target bonds with lower credit ratings but higher yields.

3. Hybrid Funds

Hybrid funds, also known as balanced funds, invest in a mix of equities and debt to balance the risk and return. They aim to provide both growth and income. Common types of hybrid funds are:

- Aggressive Hybrid Funds: Have a higher allocation to equities compared to debt.

- Conservative Hybrid Funds: Have a higher allocation to debt compared to equities.

- Balanced Hybrid Funds: Maintain an equal balance between equity and debt investments.

4. Index Funds

Index funds aim to replicate the performance of a specific market index, such as the S&P 500 or the NASDAQ. They offer broad market exposure, low operating expenses, and low portfolio turnover. Index funds are a popular choice for passive investors looking to match market returns rather than outperform them.

5. Sector Funds

Sector funds invest in a specific sector of the economy, such as technology, healthcare, or energy. They are ideal for investors who want to focus on a particular industry they believe will outperform the broader market. However, they come with higher risk due to the lack of diversification across other sectors.

6. Money Market Funds

Money market funds invest in short-term, high-quality debt securities such as Treasury bills, commercial paper, and certificates of deposit. They aim to provide a safe place to invest easily accessible, cash-equivalent assets. These funds offer lower returns but come with very low risk.

7. Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks. They offer the diversification of mutual funds with the flexibility of stock trading. ETFs can track various indexes, sectors, commodities, or other assets.

Benefits of Investing in Mutual Funds

1. Diversification: By investing in a mutual fund, you spread your investment across a wide range of assets, reducing the impact of poor performance by any single investment.

2. Professional Management: Fund managers have the expertise to make informed investment decisions on behalf of the investors.

3. Convenience: Mutual funds provide an easy way to invest in a variety of assets without the need to manage each investment individually.

4. Liquidity: Mutual fund shares can be bought and sold on any business day, providing investors with flexibility and quick access to their money.

5. Affordability: Many mutual funds have low minimum investment requirements, making them accessible to a broad range of investors.

Conclusion

Mutual funds offer a versatile and accessible investment option for both novice and experienced investors. By understanding the different types of mutual funds, investors can choose the ones that best align with their financial goals and risk tolerance. Whether seeking growth through equity funds, income through debt funds, or a balanced approach with hybrid funds, mutual funds provide a structured way to achieve financial objectives.

By investing in mutual funds, you can benefit from professional management, diversification, and ease of access, making it a valuable addition to your investment portfolio.

This comprehensive guide should give you a clear understanding of mutual funds and their types, helping you make informed investment decisions.